We've updated our B2B sales benchmark data for 2024. Some of these metrics are the same as last year, while others have changed. And we'll keep this post updated throughout the year as new studies and reports are published.

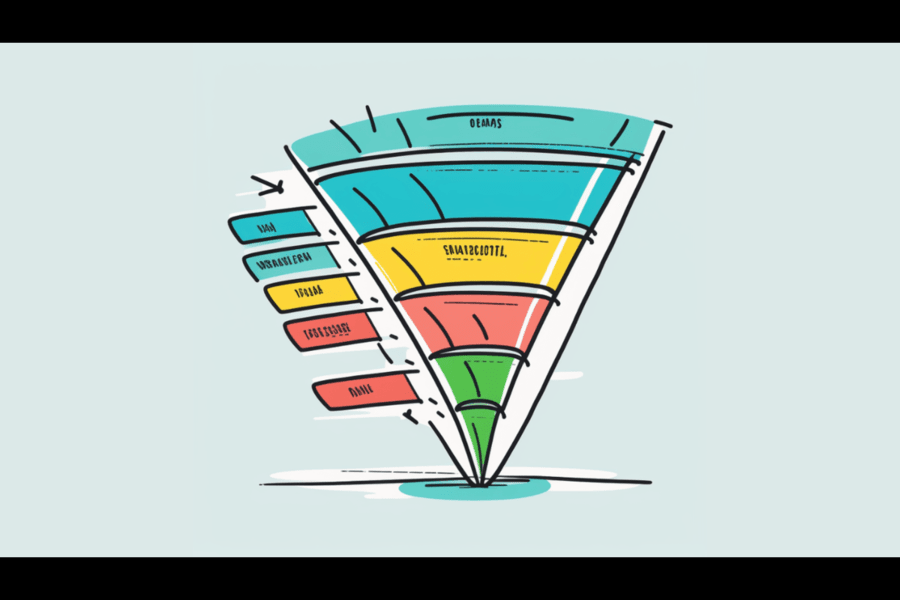

Below, you'll find benchmarks and industry averages for everything in your sales and marketing funnel, from MQL to SQL conversion rates to seller activity and capacity baselines to pipeline metrics. See how your B2B sales team measures up.

Marketing and sales funnel conversion rates

First, here are some benchmarks to help you decide how your B2B sales funnel conversion rates stack up.

General changes in 2023

-

Win rates have decreased to 17-20% (2023, Winning by Design)

-

Number of stakeholders in a deal increased to 10 in 2022 (2023, Ebsta & Pavilion)

-

42% of companies saw a decrease in quota attainment in 2022 (2023, Everstage & RevOps Co-op)

-

63% of companies are facing significant challenges with outbound (2023, Everstage & RevOps Co-op)

-

Pipeline generation down 47% in 2022 (2023, Ebsta & Pavilion, see chart below)

Inbound to MQL converstion rates

-

11-15% (2023, Winning by Design)

-

12-25% (2018, Gartner)

-

33% (2022, RevOps Squared)

-

39% (2021, First Page Sage)

MQL to SQL conversion rates

-

12-26% (2018, Gartner)

-

16-20% (2023, Winning by Design)

-

21% (2019, TOPO/Gartner)

-

20% (2022, RevOps Squared)

-

38% (2021, First Page Sage)

SQL to opportunity conversion rates

-

42% (2021, First Page Sage)

-

59% for SDR-sourced leads (2019, TOPO/Gartner)

Opportunity to close conversion rates

-

6% (2014, Implisit & Salesforce)

-

10-28% (2023, Winning by Design)

-

37% (2021, First Page Sage)

-

22% for SDR-sourced deals (2019, TOPO/Gartner)

Sales cycle length

-

Sales cycles lengthened 32% from 2021 to 2022 (2023, Ebsta & Pavilion)

-

Nearly half of companies have seen increases in sales cycles (2023, Everstage & RevOps Co-op)

-

Startups have seen a 24% increase in sales cycle, with the biggest increases in enterprise deals, which are 36% longer (2023, Tomas Tunguz)

SDR, BDR and AE benchmarks

Next, here are the metrics to help you benchmark your sales reps' performance.

Touches per account

-

At least 8 touches per account (Hubspot)

-

16 touches per account (TOPO)

-

Average cadence has 10.6 attempts (Bridge Group)

Rep capacity

-

75-125 accounts per rep (TOPO)

-

100-300 leads per rep month (TOPO)

-

80 accounts per month (400 contacts with 5 contacts per account) (Terminus)

-

101 accounts per month (Storm Ventures)

-

Reps can handle 15 inbounds per day (Operatix)

-

300 leads per month can support 1 rep (Gartner)

Activity rates

-

100 emails per day with some personalization (KiteDesk via Quora)

-

70 tailored emails per week (Operatix)

-

40-50 calls per day, 10-40 emails per day (Operatix and Bridge Group)

-

80-100 total activities per day (Bridge Group and Tenbound)

-

25 accounts per month and 200-300 contacts (Gartner)

Response rates

-

Most cold emails get a 1% to 5% reply rate (GMass)

-

12% reply rates for effective sequences (Outreach)

-

It takes 18 or more dials to connect with a prospect over the phone and call-back rates are <1% (Gartner)

-

Reps see an average of 4.4 connects per 100 touches (The Bridge Group)

-

1 of 59 calls ends in a meeting (Keller Center)

Multi-threading

SLAs

-

Only 7% of companies respond to new leads within the first 5 minutes (Drift)

-

The average response time is 42 hours (Harvard Business Review)

-

More than half (55%) of companies do not even respond over the course of 5 business days (Drift)

Meetings

-

5-25 meetings booked per month (Operatix)

-

1.3 meetings per day (Tenbound)

-

Outbound SDRs produce 15 meetings a month, with an 80% show rate, leading to 12 meetings held per month (Operatix)

-

21 meetings per month, 62% conversion rate (The Bridge Group)

-

5-10% of lower intent leads (content downloads, webinar attendees, etc), will convert to a meeting (Crunchbase)

-

75-80% of high-intent leads (demo requests, etc) will convert to a meeting (Crunchbase)

Opportunities created

-

SDRs should create 4 SAOs per month (Operatix)

-

58% of SDR-qualified leads end up as opportunities (TOPO)

- Average lead-to-opportunity pipeline conversion rate for SaaS companies is 12% (OpenView Partners)

Pipeline

-

Pipeline generated varies by ACV, but SDRs generate between 46% and 73% of pipeline (TOPO)

-

Outbound SDRs are responsible for 53% of pipeline (Tenbound)

- 71% of sales development teams deliver less than half the sales pipeline (Revenue.io)

-

Outbound SDRs generate 30-45% of sales pipeline, median pipeline of $3M per year (The Bridge Group)

-

Median pipeline generated is $2.7M annually (BlossomStreetVentures)

- For lower ACV companies (<$25k), SDRs generate $191k in pipeline monthly. For higher ACV companies (<$25k), SDRs generate $600-700k in pipeline monthly. (TOPO)

Revenue

-

22% of SDR-sourced opportunities end up as closed-won deals (TOPO)

-

Only 32% of companies track closed-won revenue for SDRs (Tenbound)

Ideal SDR:AE ratio

-

The average is 2.6 AEs for every 1 SDR. With higher growth, smaller companies may experience a tighter ratio (BlossomStreetVentures)

Inbound vs outbound

-

36% of companies have hybrid roles (TOPO)

-

There are generally 2 outbound SDRs for every 1 inbound SDR (BlossomStreetVentures)

Quota attainment

-

56-60% of SDRs achieve quota (Tenbound)

-

On average, 68% of SDRs achieve quota (BlossomStreetVentures)

Not measuring up to these benchmarks?

Get your team in shape with these resources and ideas to improve sales rep effectiveness.

-

Download our free SDR leader toolkit filled with resources to help make your SDR team successful

-

Get a free Market Map to help you identify easy wins and high potential prospects hiding in your CRM

-

Access our rules of engagement template and guide to help clear up how your reps work together

- Read these 5 tips for increasing focus on your sales team