We keep saying that pipeline starts with account coverage, but what does that really mean? Let's start by talking about account coverage and how you segment your market.

TAM, SAM, SOM and account segments

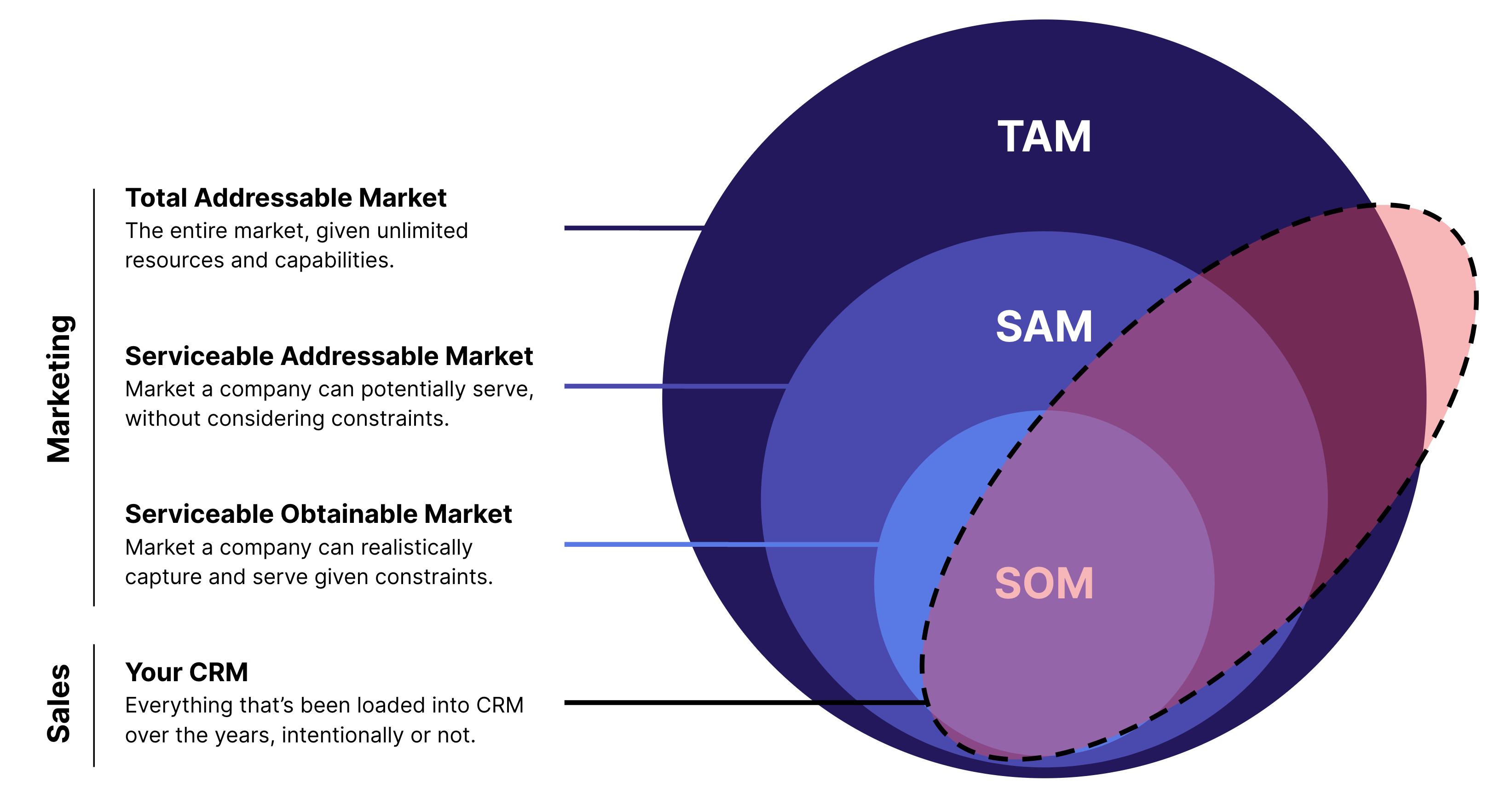

You've probably seen a diagram like this before. It shows how most companies think about their segmenting their market.

The diagram includes:

-

TAM (Total Addressable Market): The entire market, given unlimited resources and capabilities.

-

SAM (Serviceable Addressable Market): The market a company can potentially serve, without considering constraints.

-

SOM (Serviceable Obtainable Market): The market a company can realistically capture and serve given constraints.

-

Your CRM Data: Everything that’s been loaded into CRM over the years, intentionally or not. That probably includes some relevant accounts and some less relevant accounts.

We can further break down these markets into more specific account segments - labeled with the letters A-G as shown below.

.png?width=960&height=540&name=SOM%2c%20SAM%2c%20TAM%2c%20CRM%20Graphic%20(1).png)

These smaller segments help you understand where to focus sales and marketing resources. A huge thank you to Erik Huddleston for naming and describing these segments. He defines them as follows:

-

The giant hole in your demand generation processes. These are accounts you should be working, but they're not in your CRM. That means marketing should be working hard to target and get in front of generate demand from this segment so they move from A to B.

-

Accounts you should be working (but sometimes can’t because the data is wrong). This segment highlights the most important accounts you've got - the ones your sales team should be focused on. But Zoominfo data can be out-of-date, contacts move jobs, phone numbers change. Set up integrated systems that help you increase data quality and return bad data accounts to ops to fix.

-

Hold my beer accounts. These are the accounts your team may want to work on, but you can't service them well just now. Maybe your product isn't ready for this group yet, or they're not yet ready for your product. They're the shiny objects distracting your team from working on the better accounts in the B group.

-

Sins of your youth. These are the old crusty accounts that linger in your CRM. Maybe they're from old experiments, past campaigns, or a time before you refined your ICP. They're time wasters.

-

Forbidden fruit. These accounts look good on paper, but you're not ready to sell to them. Targeting in marketing needs to be careful not to market to them now - even if it increases their inbound lead volume - and instead focus on accounts in the A segment.

-

Growth delusion. These are the accounts that look good to your investors, and that's pretty much it right now.

-

Garbage. Cruft in your CRM that has nothing to do with what you sell now or in the future. Remove them.

Where marketing and sales live in these market segments

Marketing spends a lot of time in the A-E-F groups. We think of this as the "outside world" (it's quite literally the world outside our CRM). Marketing segmentation should be focused on building demand gen campaigns for group A, to move more of those accounts into group B. Erik calls segment A the "giant hole" in demand gen and that's true for more mature companies. If you've been targeting the same SOM for a while, A is in fact a hole you've missed.

If you're a startup or growth company with a large enough SOM, then most likely your A group will be vastly larger than your B group. This represents your opportunity for immediate growth without having to make major product advances. You can reach these accounts with the resources you have now - you just need better or more targeted marketing.

Sales lives in the B-C-D-G area. Most organizations task sales with going after what's in the "inside world" of their CRM. The job of quota capacity allocation demands that you figure out which accounts fall into which segment and execute on that - both in your inbound lead automations and your territory design.

(This is why we have the concept of "enrolled accounts" in Gradient Works Bookbuilder. It allows you to build a wall around your pool of available accounts to constrain them to those that are in your SOM. More on this in a minute.)

When sales doesn't have good control over account allocation, then you get a lot of reps going after segment C. Erik refers to these as the "hold my beer" accounts. You've gotten a couple of flukey wins and before you know it the whole sales floor is going after these low-probability, high-churn-potential accounts. This impacts both new business and retention efficiency.

However, it's important to remember that SOM, SAM and TAM are fuzzy concepts. The frontier between SOM and SAM, in particular, is one you should explore. Perhaps there are some ways to extend the SOM horizon out a little farther. With dynamic books, the best sales teams use distributions to run targeted plays that probe that barrier intentionally, no beer-holding required.

Pipeline starts with SOM account coverage

As a sales leader, it's your job to focus rep effort on the best fit, highest timing accounts in your SOM. Ensuring effective account coverage is a shared responsibility between marketing, ops and sales.

Account coverage requires continuous adjustment. You have to actively manage coverage all the time; it’s no longer sufficient to relegate this to a once-a-year territory planning process.

Other ways to improve account coverage:

1. Integrate rep-level account coverage analysis into every 1:1. Help reps learn how to better cover the best accounts in their books or territories. Show them which accounts to focus on and which to ignore.

2. Identify “black holes” in your market coverage. What accounts are you missing out on? Make sure you're engaging every account in the A group, and look for accounts your team could be working in the B and C segments.

3. Inject flexibility in account assignment. To ensure adequate coverage, you will likely need to retrieve accounts reps can't or shouldn't work right now, and give them more and better accounts to work.

Here's a good example of how a flexible approach account coverage can work, from our friends at Beekeeper:

"One of our core customer industries is manufacturing, but hard goods manufacturers have been really impacted lately because of supply chain issues. We saw all our deals in hard manufacturing dragging out, whereas our deals in a few other industries were doing well. And so we were able to quickly use Bookbuilder to deprioritize both account distribution and our marketing focus so that we weren't targeting hard manufacturing companies right now, because we know the deals are just stalling. We're able to quickly react to what's going on in the market and refocus our energy into areas where deals are moving still reasonably well."

Finally a word about dynamic books and enrolled accounts

Earlier, I mentioned that you probably or should have a pool of accounts that are available to be distributed to sales reps, so that you can focus sellers' efforts on the most important accounts in your SOM. At Gradient Works, we call those "enrolled accounts" - the pool of eligible accounts you're managing and distributing in a dynamic books process (hopefully with our Bookbuilder!). There are probably a lot of accounts in your CRM that you don't want being distributed to reps, now or in the near future, and you want to separate those distractions from the accounts with the highest potential.

So, which accounts in your CRM should you enroll in Bookbuilder? First, enroll every account in group B - the accounts in your serviceable addressable market that are currently in your CRM. Those are the majority of the accounts you'll want to distribute to reps. And as accounts move from A to B (SOM accounts from the outside world that come into your CRM), enroll those as well

Second, include a set of accounts from group C that you think should be a good fit but are outside the accounts you typically sell to. Why? This is so you can run small tests on other types of accounts to try to expand the horizon of your SOM. It allows you to find new sales plays to reach other accounts you haven’t been able to reach yet. This becomes especially important in times like we're dealing with right now, when everyone is trying to find new, untapped areas for pipeline development. A dynamic books approach allows you to quickly and easily distribute new accounts for testing, helping you identify new account segments to target, like in the Beekeeper example above.

With a little time and rigor, you can identify key account segments in your CRM to improve pipeline by focusing on the right accounts in your SOM. From there, you can manage account coverage more effectively and inject some flexibility into your distribution approach.

.png)